Payroll in Australia has some unique requirements. Single Touch Payroll has been a requirement for two years now, with the final exceptions expiring by July 1st prior to Covid19 - if you are not on a STP compliant payroll system by now, you only have weeks to get this arranged. An extension for closely-held employers[1] to July 2021 has been applied[2]. Another temporary element is - JobKeeper payments. If your payroll system is not "JobKeeper Ready" - you are in for some significant administrative overhead - at the time when you can least afford it. Aurelian Group partners with CloudPayroll to provide a solution that can assist you.

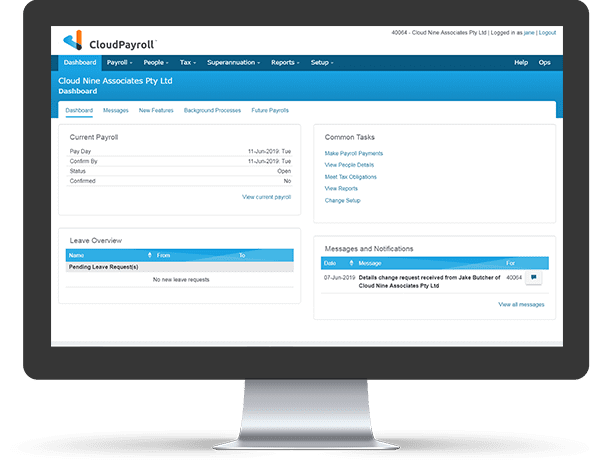

Aurelian Group and Cloud Payroll - your end-to-end payroll solution

At Aurelian Group we pride ourselves with making business systems work for you - you focus on your customer, we take care of your systems. CloudPayroll fits neatly into this philosophy. Keeping things simple, compliant and affordable.

There are three ways to engage Aurelian Group and CloudPayroll

- Payroll systems access - you process yourself

- Payroll managed services - all payroll activities done right, hassle free

- Digital Business Service Plan PLUS Payroll - a true end-to-end managed service for all your business applications - we implement, maintain, support and enhance your business applications for a monthly fee that includes services and licenses.

The case for Managed Services

With the current disruption to businesses, services, and the overall economy, we do see a global move towards managed services. Partly due to appropriate risk mitigation (being an employer in Australia comes with burdens on compliance, and a not insignificant payroll tax). We support employment - especially for the small to midsize business segment - but we believe the best use of company resources is in direct service to customers. The Digital Business Services plans offer a complete digital transformation for your business, executed in a pragmatic, affordable, and professional manner. You focus on your business, we do the rest. This includes Payroll - CloudPayroll professionals prepare the pay run from details provided by the client, you will review and then confirm. Easy, and peace of mind - all in one Digital Business Services plan.

- A closely held employee is one who is a non-arm’s length employee. This means they are directly related to the entity from which they receive payments, for example:

- family members of a family business

- directors of a company

- shareholders or beneficiaries. - Source: https://www.ato.gov.au/Business/Single-Touch-Payroll/Concessional-reporting/Closely-held-payees/