When is money not money? Not to disregard the various financial constructions, in a general sense money is money when you have it at your disposal. For small businesses and startups, the liquid cash position is essential to survival. It is not lack of profitability that does many businesses in, it is the cash-flow position. Days Sales Outstanding is a major KPI that drives the cash on hand. Minimising Days Sales Outstanding simply makes your money go further.

How to calculate Days Sales Outstanding (DSO)

There is a very simple formula for Days Sales Outstanding. Simply divide the accounts receivable by the total of credit sales in that period, and multiply that result by the number of days in that period.

How do you manage DSO?

The task of the accounts receivable department is to keep DSO within the parameters. Too short, and you are a strain on your customer's liquidity. Too long, and you are doing your own cash-flow a disservice. Managing your DSO as close as possible to your payment term is a safe target to have. For small businesses, you need to get paid within the 10 days. For larger organisations this tends to be a bit longer - but over 45 days should be avoided.

The simplest way to lower the DSO may not be be most effective for your business: simply reduce your payment terms. As stated above, you are just moving the cash-flow problem towards your customers (who will find other vendors with more suitable payment terms.

Another, better, way to manage the DSO KPI is to gently nudge your clients to adhere to the stipulated payment terms. This starts with gentle nudges and reminders - some even a few days before the invoice is actually due - and slowly but politely stepping up in seriousness and pressure. Many small business owners do not execute an accounts receivable strategy. Larger organisations tend to have an accounts receivable management department that manages this - albeit mostly manual and therefore not always as consistent as desired.

Aurelian Group partners with Paycepaid

To offer you best practice automated accounts receivable management, with proven methods to get paid faster, and maintain a positive relationship with your clients.

In the vast majority of cases, consistent, structured reminder and follow-up strategy get your accounts receivable converted into liquid cash on or close to the payment terms you have set out with your clients. Automated receivables have proven to improve payment time significantly.

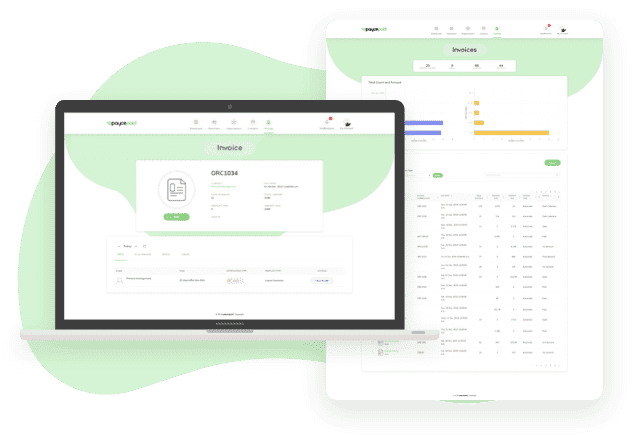

Paycepaid will manage invoices automatically, sending regular follow-ups via, email, SMS and phone calls. Paycepaid will replace the traditional collection efforts by digitalising 80% of the day to day collection. Paycepaid software includes Interactive dashboard allows cash forecast, cash collection and revenue comparison and monitor invoices 24x7, completely customisable and branded emails and SMS communication.

In the unfortunate isolated cases where this is not yielding the expected result, by a click of the mouse, you can "escalate" an outstanding invoice to a debt collection agency or issue a legal demand letter from within Paycepaid

.

By utilising the automated receivable solution, you can automate the traditional workload and achieving the following:

Increased Cash Flow

Improved Customer Experience

Reduced Operational Costs and DSO

Reduced Workload & Headcount

Avoid Early Legal & Collection Agencies Intervention

Best of all, peace of mind that accounts receivable account is converted into cash that can be used to cover business costs and investments to grow your business.

Paycepaid Accounts Receivable Management is included in the Digital Business Gold and Digital Business Platinum plans and is available as an option on the Digital Business Solopreneur, Digital Business Micro-business, and Digital Business Corporate plans.