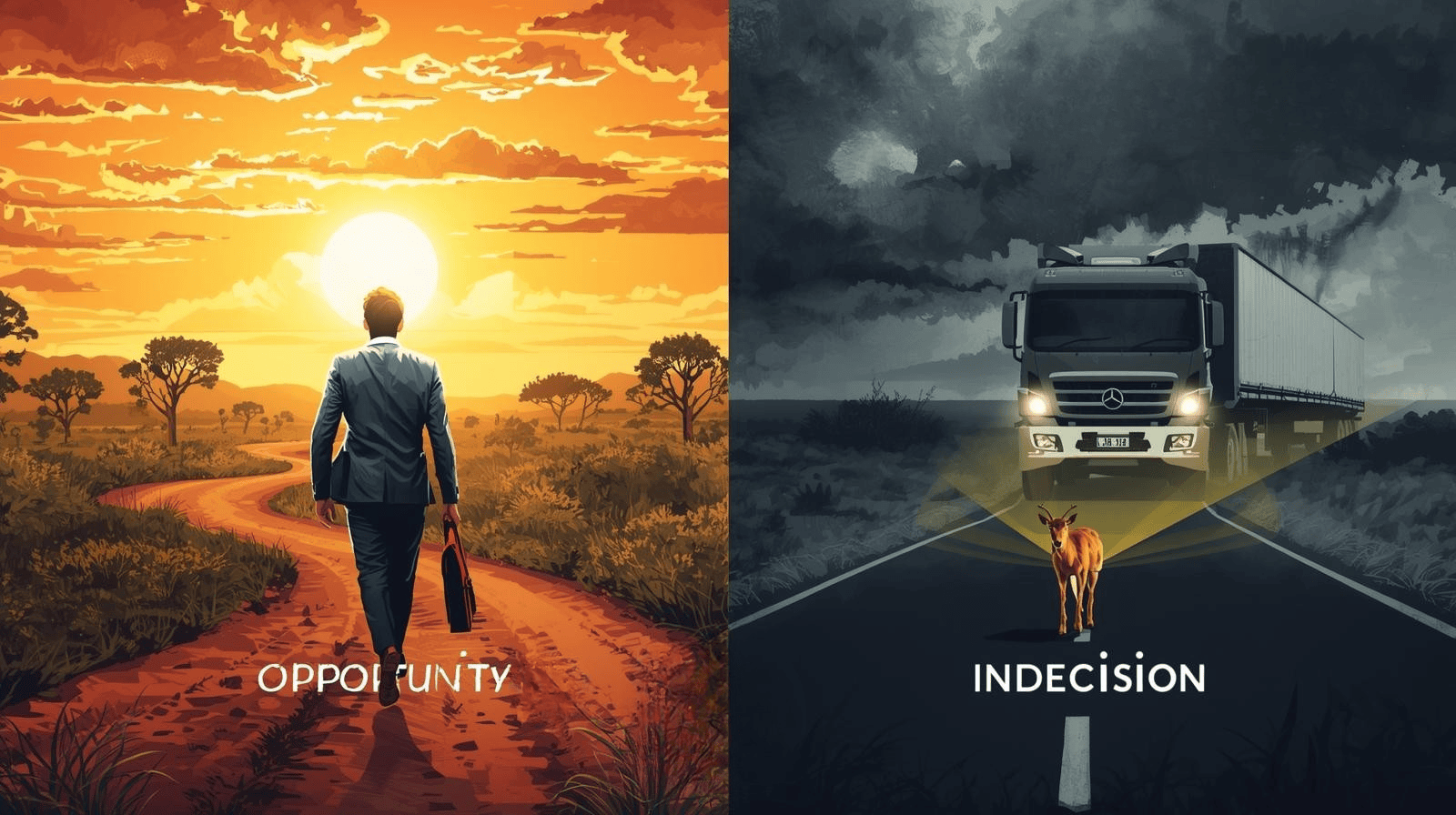

We have all experienced that moment. The decision looms large, and we hesitate. Like a deer caught in the headlights, we freeze. In business, this indecision strikes at the heart of risk management. Opportunities slip away, threats grow closer, and the window for action narrows with every passing second. Today, we unpack risk assessment as a practical formula. We explore probability multiplied by consequence, and the hidden toll of mitigation costs. Most critically, we reveal how upside risks—those positive potentials—fade when we delay. This is not mere theory. It is a call to move decisively, before the truck arrives.

The Risk Formula: Probability Meets Consequence

At its core, risk boils down to a simple equation: Risk = Probability × Consequence. Probability represents the likelihood of an event occurring. Consequence captures the impact if it does. Yet this formula demands nuance. We must factor in the cost of mitigation—the investment to reduce probability or soften consequence—and weigh it against the potential fallout.

Consider a supply chain disruption. The probability might stand at 20 per cent due to geopolitical tensions. The consequence? A 15 per cent revenue drop, costing your organisation $150,000. The raw risk equals $30,000. Now layer in mitigation: a diversified supplier network costs $10,000 upfront but halves the probability to 10 per cent. The adjusted risk falls to $7,500. The net benefit? $22,500 saved, minus the mitigation outlay.

This approach empowers clear decisions. It transforms vague fears into actionable numbers. Businesses that apply it avoid knee-jerk reactions. They allocate resources wisely, safeguarding operations without overcommitting budgets.

The Price of Mitigation: Invest Now or Pay Later

Mitigation costs demand scrutiny. They are not expenses. They are insurance premiums against catastrophe. Yet over-mitigation drains resources from growth. The key lies in balance. Assess each risk's probability and consequence thresholds. If probability exceeds 15 per cent and consequence tops $50,000, mitigation merits priority.

Take cybersecurity. A data breach probability hovers at 25 per cent annually. Consequence? Fines, lost trust, and remediation exceeding $200,000. Mitigation via advanced firewalls and training totals $20,000 yearly. The return? Probability drops to five per cent, slashing risk to $10,000. That $20,000 investment yields peace of mind and preserved capital.

In Australia, where regulatory scrutiny intensifies under evolving privacy laws, this formula proves invaluable. It aligns protection with compliance, turning potential liabilities into strategic strengths.

The Downside Trap: When Inaction Amplifies Loss

Negative risks compound through delay. Probability often rises unchecked—suppliers falter, markets shift—while consequence swells via lost momentum. Mitigation windows close. Costs escalate. What starts as a $10,000 fix balloons to $100,000 in crisis mode.

The Overlooked Upside: Diminishing Returns of Delay

Here is the sharper edge. Upside risks—opportunities for gain—demand swifter action. These are the market entries, innovations, or partnerships that propel growth. Indecision erodes their value exponentially.

Picture the deer again. At 500 metres, the truck offers choices: veer left to safety or right to opportunity. At 100 metres, options blur. At 50, collision looms. So it goes with business upsides. A new product launch, assessed at 40 per cent probability of $500,000 gain, carries zero mitigation cost beyond timing. Delay halves probability to 20 per cent as competitors encroach. The upside? Now $100,000, then nothing.

We see this in Australian enterprises daily. A hesitant pivot to e-commerce amid digital surges leaves shelf space to agile rivals. The formula applies inversely: Upside Value = Probability × Gain Potential. Act early to lock in high probability. Delay, and the equation zeros out.

Seize the Moment: Assess, Act, Advance

Risk management is not paralysis. It is calculated momentum. Apply the formula today: quantify probability and consequence, budget mitigation smartly, and chase upsides before they vanish. Your organisation thrives on decisions made, not deferred.

To adequately assess the risk (and opportunity) it is essential you have access to valid, current, and actionable information. Aurelian Group provides your business with end-to-end solutions that help you manage your transactions efficiently and effectively, flowing downstream to your finance and business intelligence systems; all securely encrypted, minimising the risk of data loss or malicious manipulation.