Expenses - without incurring expenses, it is impossible to conduct business. Whether you are a sole entrepreneur, or a large enterprise - expenses are part of doing business. Whether you use petty cash, or a corporate credit card - the hidden costs of expenses are in the handling of the administration. How do you keep track of your business expenses?

Receipts - the bane of our existence?

I remember doing my expense claim after a week of travel - all the receipts neatly stapled on an A4 sheet, and an accompanying spreadsheet detailing and itemising the expenses - on to accounts, where everything was keyed into the financial system, and eventually I would get reimbursed.

The hidden cost is significant - I had to keep the receipts neatly ordered (try keeping that up when you are a road-warrior). Then I needed to stick them to a paper, enter each receipt as a line item on a spreadsheet, and then the recipient entered the transactions in the financial system, and archived the receipts against the voucher number of the expense entry. As a small business owner, you can substitute the recipient entering the receipts into the financial system with your bookkeeper. Not that it makes much difference - the former is an employee costing a large organisation a salary, the latter is someone you pay per hour.

Expense policies

Expenses represent a cost to the business, they are part of your business operation. Working with employees that log expenses, it is good to have policies in place, and a framework to make it easy for employees to understand and comply, and for approvers to verify - and where necessary reject the expense or create an exception. Negotiating the policy documents every time you log or approve an expense is not a practical solution - it costs more in time than the potential savings of preventing the policy violation. Furthermore - the longer the time between the expense incurred and the detection of the policy violation, the more difficult it is to rectify the situation.

Cost of processing time

The time between the expenses incurred and the time you process them has a cost associated as well. From the person logging the expense, there is the cost of cash-flow, just that little bit less credit left on the card (or a lot - in case of frequent travel), and for the organisation - the sales tax can be claimed upon receipt and booking of the expenses. Further, it is good practice to keep the expenses as much in line as practicable with the reporting periods, and the time frame in which the revenue was made.

Simply your expense management with Zoho Expense

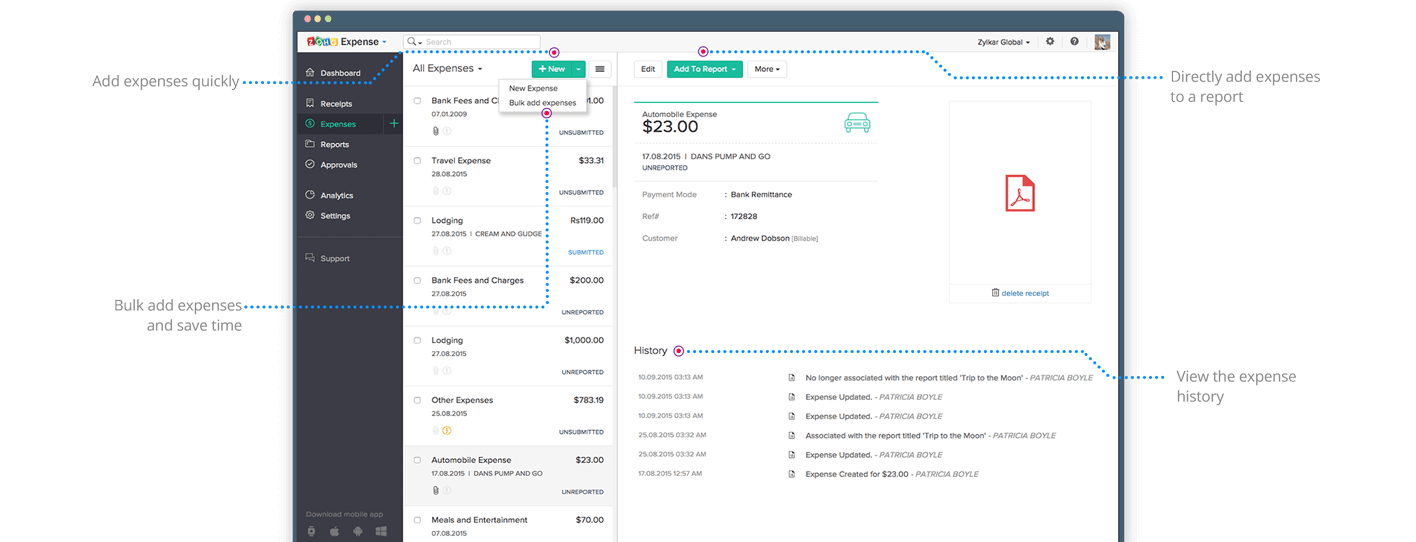

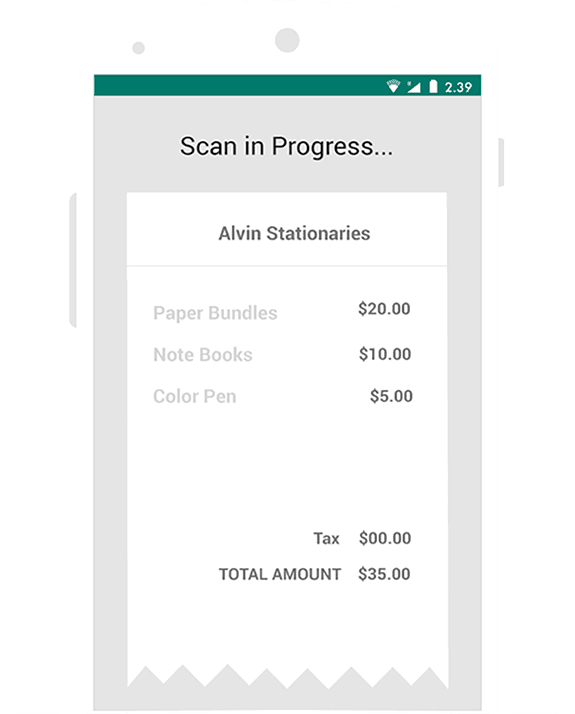

Zoho expense offers a simple to use client for desktop, tablet, and mobile phone (iOS or Android) that simplifies your expense recording, reporting, approval, and reimbursement management. On the desktop - simply drag the receipt (which you may have in PDF form) to your receipt inbox - and Zoho Expense automatically scans the relevant details for you. Alternatively, simply select a portion of a website with your receipt in it with the Zoho Expense web-browser add-on to capture, scan, and recognise your expense details. From the mobile phone, simply take a photo of the receipt through the Zoho Expense app (available for iOS and Android), and the scanning process begins. If you need to record mileage, you can enter it manually, or let the Zoho Expense app do it for you via the GPS. Received an expense receipt in your email? Simply forward it to your personal Zoho Expense email address, and it gets recorded and scanned automatically. At the end of the week (or whatever period you choose), you simply categorise your expenses, add them to a report, and submit. Finally, you can link your corporate credit card to Zoho Expense - and simply reconcile your expenses.

All policies are recorded in Zoho Expense, and enforced upon entry of the expense - for instance you can enforce the limit of expense amounts, require receipts of expenses above a certain amount, and make descriptions mandatory. You can also set up "per diem" expenses by country and currency for the frequent travellers. Policy violations can be blocking (i.e. you have not categorised the expense, or you have not entered the description, if these are set to mandatory). or provide a policy violation warning upon entry and approval (this does not stop the expense to be recorded - but makes the violation of policy very explicit, and justification can be sought and recorded).

The cost?

Expense management solutions too expensive? If you break it down - you cannot afford not to have one - say you have one expense report per month - you save the receipts, enter it in Excel, and send it to your accountant/bookkeeper or finance department - lets take a conservative approach and say that this takes 30 minutes in total - most likely that would take a lot more. Now, let's take the hourly cost of yourself and the person recording the expenses in the financial system and apply 15 minutes each - that is your cost of expenses per month in this very conservative scenario.

Zoho Expense starts with a free plan - that is $0 per month - for up to 3 users, 5 GB of receipt storage, and 100 auto-scans. With prices this low, you cannot afford not to use this, no matter how few expenses you have per month.

Zoho Expense Standard costs $40 (AUD)/$30 (USD) per company per month (dropping to $30 (AUD)/$25(USD) per month if paid annually). In this licence you get 10 users, unlimited auto-scans and unlimited storage for your receipts, plus all the advanced features as described above. Additional users will cost $4 (AUD)/$3 (USD) per user per month (or $3 (AUD)/$2.50 (USD) per user per month if paid annually).

At these prices, you cannot afford to wait and get started.