Small businesses, employing over 5.1 million Australians and comprising 97.2% of all enterprises, are the backbone of the nation’s economy. As we enter the 2025–26 Financial Year (FY26), these businesses face a complex economic environment with rising costs, cautious consumer spending, and increasing regulatory demands. However, their agility and ability to operate leanly provide a competitive edge over larger competitors. The Zoho One suite, with its integrated financial tools like Zoho Books, empowers small businesses with real-time insights and streamlined operations, enabling them to thrive in FY26.

Economic Challenges for Small Businesses in FY26

Australia’s economy in FY26 presents significant hurdles for small to medium-sized enterprises (SMEs). The Reserve Bank of Australia (RBA) highlights subdued demand growth, persistent input cost pressures, and elevated interest rates, which disproportionately impact SMEs due to their limited financial buffers. Key challenges include:

- Rising Operational Costs: Zoho’s Financial Health of Australian Small Businesses report shows 89% of SMEs have faced cost increases over the past 18 months, with 20.7% reporting spikes of 21–40%. Materials, wages, rent, and utilities remain key drivers, forcing 78% of businesses to raise prices to protect margins.

- Reduced Consumer Spending: With 73.9% of SMEs reporting slower revenue due to cautious consumer behaviour, sectors like retail and hospitality face headwinds. The Australian dollar’s recent fall to 59.15 US cents increases costs for importers, further straining budgets.

- Limited Access to Capital: RBA data indicates stagnant growth in small business loans, with strict lending criteria and high interest rates hindering SMEs’ ability to secure finance. This restricts investments in growth or resilience against economic volatility.

- Regulatory Burdens: Recent industrial relations reforms, including a 5.2% minimum wage increase and flexible work mandates, stretch SME resources. Compliance with emissions standards and cybersecurity regulations, such as the Privacy Act 1988, demands time and investment.

- High Failure Rates: The Australian Bureau of Statistics (ABS) notes that 60% of businesses fail within three years, with 20% closing in their first year, often due to inadequate financial management or market research.

Opportunities Through Agility and Lean Operations

Despite these challenges, small businesses hold a key advantage: agility. Unlike large corporations slowed by complex decision-making, SMEs can swiftly adapt to market shifts, adopt new technologies, and meet evolving customer needs. Lean operations amplify this edge, and solutions like Zoho One enable SMEs to seize opportunities in FY26.

- Digital Transformation: Integrated tools within Zoho One, such as AI-driven analytics and CRM, allow SMEs to streamline processes and deliver exceptional customer experiences. PwC identifies superior customer service as a key FY26 trend, and SMEs can leverage Zoho One to provide personalised interactions that larger firms struggle to match.

- Workforce Flexibility: Hybrid and remote work models enable SMEs to access a broader talent pool, including freelancers for short-term projects. This scalability reduces overheads compared to large, permanent teams.

- Government Support: Initiatives like the $20,000 instant asset write-off, $150 energy bill relief, and the Future Made in Australia program offer financial relief in FY26. SMEs leveraging these can offset costs and invest in innovation.

- Customer-Centric Strategies: With forecasts suggesting consumers may loosen spending in FY26, SMEs can build loyalty through tailored marketing and loyalty programs. Zoho One’s unified platform helps analyse customer data to drive repeat revenue.

- Optimism and Resilience: Zoho’s research reveals nearly half of SMEs expect improved cash flow in FY26, with 29.3% anticipating significant growth. This optimism, paired with adaptability, fuels their potential to succeed.

The Power of Zoho One for Lean, Integrated Operations

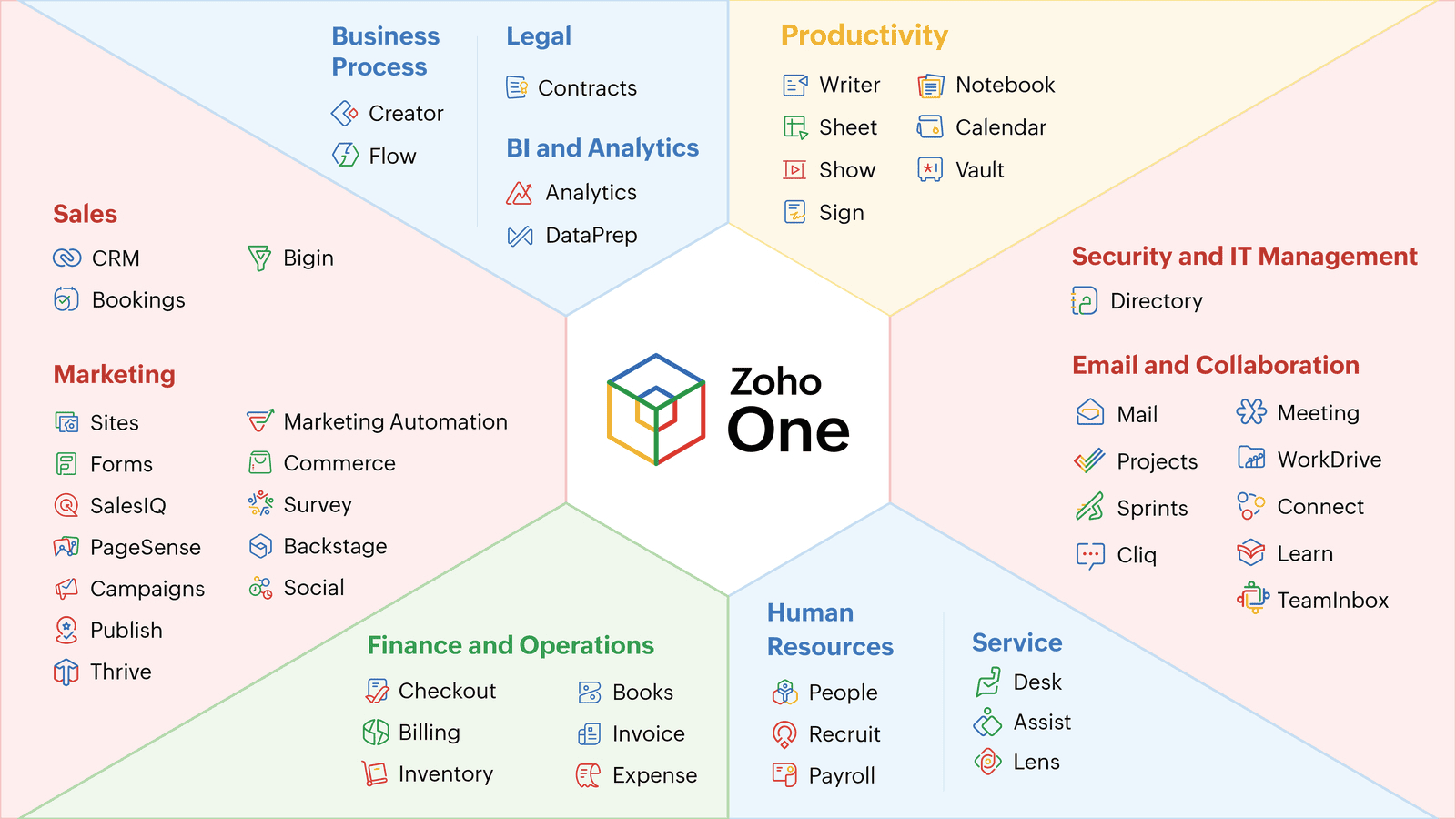

To capitalise on FY26 opportunities, small businesses need lean operations with real-time visibility into their financial position. The Zoho One suite, encompassing over 50 integrated applications, including Zoho Books, is tailored for SMEs. Unlike fragmented tools, Zoho One’s cohesive ecosystem streamlines operations, enhances agility, and delivers actionable insights.

Why Zoho One Shines for SMEs with Aurelian Group’s Expertise

The Zoho One suite, a powerful platform of over 50 integrated applications, is a game-changer for Australian small to medium-sized enterprises (SMEs). However, unlocking its full potential requires expert guidance. Aurelian Group

- Integrated Financial Oversight, Perfected by Aurelian Group

Zoho Books, seamlessly embedded within Zoho One, delivers real-time financial reports—profit and loss, balance sheets, and cash flow forecasts—through a unified dashboard. Aurelian Group elevates this capability by customising Zoho Books to align with each SME’s unique financial workflows. Their experts configure reports and dashboards to provide actionable insights, enabling business owners to monitor performance, identify cost savings, and make swift decisions without needing advanced accounting skills. For example, Aurelian Group has helped knowledge-based businesses achieve daily project performance insights, reducing invoice disputes and improving cash flow by managing Days Sales Outstanding to within 14 days. - Holistic Automation, Tailored by Aurelian Group

Zoho One automates workflows across finance, sales, marketing, and HR, with Zoho Books handling invoicing, expense tracking, and GST compliance while integrating with Zoho CRM for aligned sales and financial data. Aurelian Group takes this further by designing custom automation workflows that reflect each SME’s operational needs. They integrate applications like Zoho Books, Zoho CRM, and Zoho People to eliminate manual tasks, ensuring steady cash flow in FY26’s high-cost environment. Their “wall-to-wall” use of Zoho One internally means they bring practical expertise, building end-to-end processes that streamline operations and boost productivity. - Cost-Effective and Scalable, Implemented by Aurelian Group

Zoho One’s affordable pricing, including a forever free plan for Zoho Books, and its all-in-one model eliminate the need for costly, fragmented tools. Aurelian Group ensures SMEs maximise this value by providing predictable monthly subscriptions that cover licensing, implementation, support, maintenance, and enhancements. Their tailored rollout plans make Zoho One accessible for startups and scalable for growing businesses, removing budget barriers and aligning the platform with evolving business demands. - Global Functionality, Enhanced by Aurelian Group

For SMEs trading internationally, Zoho One’s multi-currency and multi-language features simplify transactions amid FY26’s weaker Australian dollar and rising import costs. Aurelian Group leverages Zoho’s Australian data centres in Sydney and Melbourne to ensure compliance with data sovereignty laws and optimise performance. Their global expertise, serving clients across Australia, Europe, and North America, ensures SMEs can confidently expand internationally with seamless, localised setups. - Compliance and Security, Fortified by Aurelian Group

Zoho One ensures compliance with Australian tax laws through automated GST calculations and audit-ready reports, while robust security features like encryption and multi-factor authentication address cybersecurity risks—critical given the World Economic Forum’s $10 trillion cyberattack risk estimate. Aurelian Group enhances this by implementing advanced security measures, such as Yubikey support and centralised admin panels, to monitor usage and safeguard data. Their proactive support ensures SMEs stay compliant and secure in FY26’s regulatory landscape.

Zoho One’s strength lies in its seamless integration, connecting applications like Zoho Books, Zoho CRM, Zoho Inventory, and Zoho People to create a single source of truth. Unlike standalone software requiring complex integrations, Zoho One enables SMEs to manage stock, nurture customer relationships, and track finances within one platform. Aurelian Group transforms this potential into reality by acting as an “IT department and CIO” for SMEs. They implement, support, maintain, and enhance Zoho One for a predictable monthly fee, ensuring the platform evolves with the business. For instance, a small retailer can rely on Aurelian Group to integrate Zoho Inventory, Zoho CRM, and Zoho Books, reducing inefficiencies and enabling rapid responses to FY26’s market dynamics.

Aurelian Group’s deep expertise ensures Zoho One is not just a tool but a tailored digital business platform. They use Zoho One’s admin panel to provide insights into application usage and security, optimise workflows with features like Phone Bridge for centralised telephony, and even integrate blockchain technology in Zoho Sign for secure, legally robust document signing. Their collaborative approach, as highlighted by a client, integrates disparate tools into a “tailor-made” solution, streamlining operations and driving growth.

Action for success in FY26 and beyond

Ready to transform your small business for FY26? Book a discovery session with Aurelian Group today to see how their expert implementation of Zoho One can streamline your operations, boost agility, and drive growth. Don’t wait—take the first step towards thriving in Australia’s dynamic economic landscape!